Ep. 10 – Are We in an AI Bubble?

|

This episode zooms in on the hype cycle surrounding AI and asks a blunt question: Are we in a bubble? Spoiler: Yes. To unpack that, I trace the history of the dot-com boom and bust, bring in some numbers on today’s AI players, and consider what this all might mean for companies, investors, and everyday people like you and me. A Question From the AudienceBefore diving into the bubble, I wanna to share a listener question from the good homie, Rachel, who asked: “Is it better to use ChatGPT or what if I’m using Gemini? I don’t really know why I’m using Gemini, But, I am, so should I switch?” FYI, Gemini is Google’s version of ChatGPT. The answer? Use whatever you like. At this point, the differences between the models are minimal for most people. It’s a bit like choosing between Google Home and Alexa (I’m team Google btw), and it often just comes down to vibes and which one you like better. When ChatGPT first launched, it had a clear lead in quality, largely because it was first to market. But competitors have caught up, and unless you have a very specific use case, you probably won’t notice much difference between the major players. Hopefully Rachel’s question inspires MOAR of you to reach out and ask the things. I’d love to hear from you! What Exactly Is a Bubble?A bubble is when the perceived and projected value of a sector far outweighs its actual value. The bubble bursts when, like in the Wizard of Oz, the curtain gets pulled back and folks see what’s really going on. We’ve been here before. A little story time: The Dot-Com Bubble: A Cautionary TaleThe internet in the mid-1990s was new and exciting. Investors, venture capitalists, and the public suddenly realized “this could change everything”. Suddenly, any company with “.com” in its name could attract investment, even if it had no actual business model. Stock prices soared, IPOs doubled or tripled overnight, and the mantra of the era was “get big fast.” By the late ’90s, this frenzy reached a peak. Companies raised money by promising “eyeballs” (website visitors) rather than profits. Traditional measures like earnings or revenue stability were tossed aside. NASDAQ, the tech-heavy stock index, quadrupled between 1995 and 2000. Then came the crash. By 2000, many of these businesses had burned through their cash with no path to profitability. High-profile collapses like Pets.com triggered panic. The NASDAQ lost almost 80% of its value from its March 2000 peak to late 2002. Retirement savings, mutual funds, and venture portfolios were decimated. Layoffs swept through Silicon Valley, and even Amazon saw its stock price collapse by more than 90% before it eventually recovered. (Fun Fact: it took Amazon 9 years to turn a profit.) Sound familiar? The NumbersWe are literally seeing this exact same thing happen right now with AI!!! The numbers tell the story:

Meanwhile, giants like Google (market cap of $2.3 trillion) and Meta (market cap of $1.3 trillion) remain profitable overall, even if their AI sectors are in the red, because their main product isn’t AI, it’s advertising. How Does This Happen?How in the world do these companies keep getting funding? What keeps the perceived value going up? In a word: Greed. Investors buy in hoping to sell later at a higher price. CEOs talk a good game and promise that companies will see profits because AI adoption will mean decreased expenses (aka getting rid of employees) and increased productivity. And at the heart of it all, the holy grail of achievement, is the desire to be part of the company that achieves AGI (artificial general intelligence) (see Ep. 7 if you have no idea wtf AGI is). Honestly, it’s giving Theranos. Jumping the Shark: The Oracle DealI’m gonna show my age here but OpenAI recently entered into a $300 billion contract with Oracle, and to me (and pretty much any realist in the space) it’s a very Fonzi-jumping-the-shark kind of moment. Oracle is a U.S. tech giant best known for its database software, but today it largely rents out data centers, servers, and AI infrastructure. For those of you who are unfamiliar with the show Happy Days, there was an episode near its final days where Fonzi literally jumps over a shark on his motorcycle. It was an attempt to use a flashy stunt to keep people interested, but all it really did was reveal that the show’s happiest days were in the rearview mirror. Enter: The Oracle spectacle

The numbers are wild

If this isn’t bubble behavior I don’t know what is. Are OpenAI’s Best Days Already Behind It?GPT-5 was rolled out on August 7th, the very same day that this podcast launched, and it was…underwhelming. It showed us that simply making the models bigger was no longer producing obvious improvements, and it forced OpenAI to rely on obscure benchmarks to convey progress, despite the average user not noticing a difference. This doesn’t mean innovation is impossible, and despite the perhaps perceived negativity of this episode, I do believe in the potential of AI. But it’s gonna take a team, it’s gonna take competitors working together, and that in and of itself may be what “saves” us from AGI for quite some time. For those who, like me, enjoy nerding out about possibilities, allow me to put you on to cognitive scientist and American psychologist, Gary Marcus. Gary Marcus is an advocate for neuro-symbolic systems, which combine the pattern-matching strength of neural networks with the rule-based logic of symbolic reasoning systems. This hybrid approach could eventually move us beyond the limits of today’s large language models. But, that’s a topic for another episode. 😉 Who Loses If the Bubble Bursts?

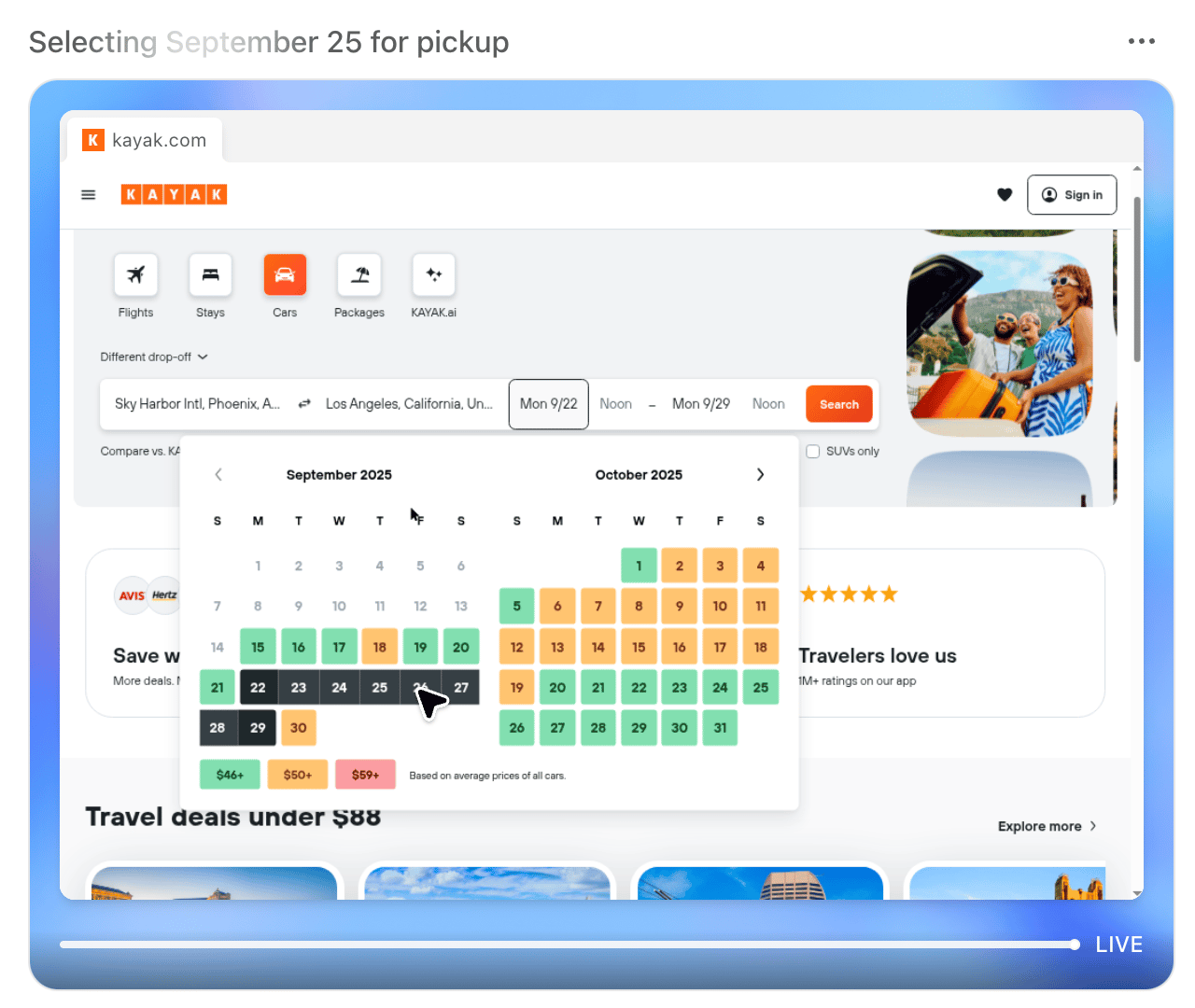

I’m not Nostradamus. I’m not here to incite chaos. I’m just here to be curious. The numbers tell the story, and I fully believe that we are in an AI bubble. When will it burst, I can’t say. What will for sure happen when it bursts, I also can’t say. But, feel free to ask ChatGPT for specifics about the dot.com bubble, and maybe you’ll be able to make some guesses of your own. How I Used ChatGPT RecentlyEach episode I include a section where I briefly discuss how I used ChatGPT that day/week. This week I gave agent mode a try. It’s pitched as one of the next big steps in AI, moving from just answering questions to actually executing tasks for you, like browsing sites and pulling data. The task: Find SUV rental prices for a one-way trip from Tempe to Redondo. ChatGPT opened up sites, clicked through menus with a little on-screen arrow, and came back with a few options and a summary…after 21 minutes!

Worth noting, it stalled out once, and would have still required a significant amount of hand-holding in order to actually complete the task. Not terrible, but also not the revolution it’s being sold as. And to me that’s the bigger point: It shows both the promise and the limits of where we’re at. Agentic AI is the future, but right now it’s clunky, slow, and fairly underwhelming. Agentic AI is the future, but right now it’s clunky, slow, and fairly underwhelming. That’s it for today’s episode. Always grateful for you. Questions, comments, concerns, additions, subtractions, requests? Hit reply or head to the website (chatgptcurious.com) and use that contact form. I’d love to hear from you. Catch you next Thursday. Maestro out. AI Disclaimer: In the spirit of transparency (if only we could get that from these tech companies), this email was generated with a very solid alley-oop from ChatGPT. I write super detailed outlines for every podcast episode (proof here), and then use ChatGPT to turn those into succinct, readable recaps that I lightly edit to produce these Curious Companions. Could I “write” it all by hand? Sure. Do I want to? Absolutely not. So instead, I let the robot do the work, so I can focus on the stuff that I actually enjoy doing and you get the content delivered to your digital doorstep, no AirPods required. High fives all around. Did someone forward you this email? Stay curious. |